ESG ALONE IS NOT ENOUGH

This is the future of innovative wealth management

partner with us

WEALTH MANAGERS KNOW THAT THEY NEED TO INNOVATE. WHEN IT COMES TO ETHICAL INVESTING, CLIENTS CONSTANTLY ASK THE SAME QUESTION:

Whats Next?Offsets alone are not the answer. Employees and customers feel increasingly skeptical about carbon credits. Many of the solutions they expect you to support fall beyond the reach of even the best offsets. We know what's next. We are redefining corporate climate leadership with a simple complement to your existing sustainability strategy.

Sustainable investing alone is not the answer. Clients increasingly view ESG labels as a gateway to greenwash. Many of the climate solutions they expect their portfolios to deliver fall beyond the reach of even the most effective ESG.

We know what's next. We are redefining competitive wealth management with a simple complement to any asset allocation strategy.

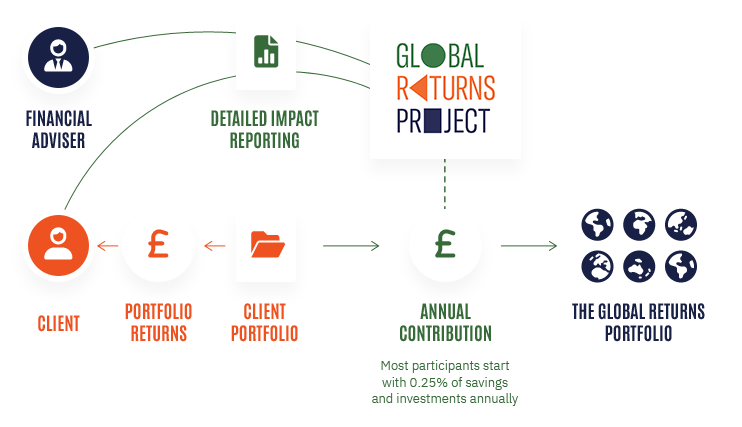

Our innovation is the Global Returns Portfolio: the first selection of diverse, effective and scalable not-for-profits tackling climate change, curated by experts. We've made it easy for your clients to contribute annually to the Portfolio alongside their other investments.

Learn more about Global Returns Portfolio

WHERE ESG FALLS SHORT

WHERE ESG FALLS SHORT

Survey after survey tells us the same thing: demand is soaring for investment strategies that take climate change seriously. But clients also know that ESG is unreliable. Research increasingly finds that the majority of sustainable

investments fail to deliver actual environmental benefits.

ESG also faces a more fundamental flaw. Even the most effective sustainable investing cannot sue polluters, protect rainforests or defend carbon-

sequestering whales. The best not-for-profit organisations tackle these and other crucial, non-market climate challenges. They impress clients with real and meaningful results.

How it works

How it works

Join other innovators in introducing your clients to the Global Returns Portfolio today. Get in touch to learn more and set up a call:

contact usClients who make an annual contribution to the Portfolio receive detailed six-monthly impact reports, along with their advisers. Participating advisers decide which of their clients to approach about the Global Returns Portfolio. Calculating an annual contribution to the Portfolio is entirely up to the client. Most clients start at an annual contribution of 0.25% of savings and investments. Contributions made by UK taxpayers may be eligible for Gift Aid and tax efficient.